https://www.youtube.com/watch?v=stAeLrgmi7A&feature=youtu.be

|

youtu.be/stAeLrgmi7A

https://www.youtube.com/watch?v=stAeLrgmi7A&feature=youtu.be

0 Comments

Hi Folks, Please see this month's blog. It contains statistics re: sales, and listing results for the month of April 2020. There is a significant decrease in sales and listings when compared to April 2019 and to March 2020 stats; but this was expected given the "Stay at home" regulations initiated by the Federal, Provincial and Municipal authorities. While real estate services are deemed to be an essential service it is not business as usual. As outlined in last month's blog, people who NEED to buy, sell or lease both commercial and residential properties are able to do so but are required to adhere to safety measures, policies and procedures for both listing of a property and viewing (buying ) a property. Christine and I are available to support and assist our clients in the safest, and most informed manner. Please contact us for further information or if you wish to list or buy real estate even in these challenging times. Helping You Is What We Do. https://www.rahb.ca/press/2020/May/Statshighlights.pdf

We are all living in challenging times as a result of the Covid19

pandemic. And while we all hope the scientists and medical researchers will come up with appropriate medical therapies and ultimately a vaccine to combat the virus, we all are now required to adjust to the practices which will keep us safe and well, while we wait. The real estate profession is considered an essential service to enable those who need to sell to continue to do so. Royal LePage State , Brokerage has provided its realtors with direction regarding the practices, policies and procedures to incorporate into showing properties, and listing properties in as safe a way as possible. Over the next few days we will be posting the information in our Blog at Larryszpirglas.com and on Facebook and Instagram. We will also show you how we view a property and how we list a property in this challenging environment of virtual tours , no physical open houses, and the importance of maintaining the safest methods available for buyers, sellers and realtors to engage in the real estate transaction. Please click HERE to see the Initial COVID-19 GUIDELINES. This information is a summary of the process; but we will be providing you with the detailed information going forward. Another part of the process is the additional paperwork for both Buyer and Seller. Look forward to your comments and if you have any questions please call or text me (905 572-1801) or email : [email protected] or Christine (905 978-1672) or email: [email protected] By Connie Adair

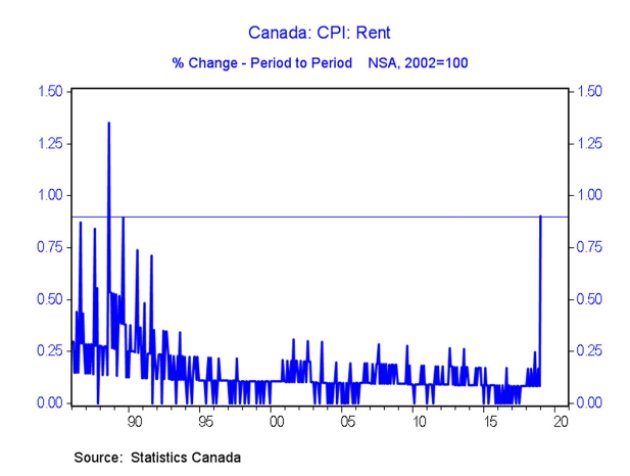

Along with a will, there are three other separate free-standing documents you need to have to protect your family: two types of powers of attorney (financial and medical) and a living will, also known as an advance care directive. Many people think they don’t need a power of attorney because they have a will, but a will doesn’t take affect until an individual dies, says lawyer Les Kotzer of Fish & Associates in Toronto. The following advice is for Ontario only. For other provinces, contact a lawyer in your area. Powers of attorney (POA) offer protection when an individual is alive but is deemed incompetent and unable to handle their own financial or medical affairs. Without these financial and medical powers of attorney, the government may step in and freeze your assets and make your financial and medical decisions for you. And no one wants that. That’s why it’s important, Kotzer says, to have your POAs prepared now when you are competent. He says everyone over the age of 18 should have both types of POAs, with medical POAs covering both mental and physical incapacity. Some people have a POA that names someone they trust to act on their behalf should they become mentally incapacitated. However, the medical POA should also include physical incapacity. As an example, Kotzer tells the story of a woman who has multiple sclerosis. She is mentally competent but is unable to sign her name. If the POA covered only her mental incapacity, her appointees would have difficulty acting on her behalf. In a first marriage, in most cases spouses who trust each other appoint each other. In another case, a man in his late 50s had a stroke. He and his spouse were listed as joint tenants on the title of their house. The matrimonial home is often in the names of both spouses as joint tenants. However that doesn’t mean that one spouse can sign the other’s name without a financial power of attorney, for example to refinance or sell the house. Having joint ownership means the other will get ownership upon death. If a doctor declares you mentally incompetent, if you have a POA, all the person you appoint has to do is tell the government you have a POA, sign some forms and the government will relinquish control. An encompassing POA, which is what Kotzer says he and lawyer Barry Fish call the document provided in their Power of Attorney kit, is like an umbrella that covers all assets until death, when the will takes over. The living will, or advance care directive, is an important document that outlines your medical wishes. Kotzer and Fish created a financial and medical power of attorney kit that you can fill out at home. The documents are not online. They are paper copies that can be witnessed by two friends or neighbours. The kits are available for $50 each plus tax and shipping. Visit powerofattorneyinfo.com or call 877-439-3999 for information. Kotzer also has videos about wills and powers of attorney on his website at www.leskotzer.com. POAs should be kept at home for easy access in case of an emergency. Tell your family where they are. The financial Power of Attorney kit also comes with a wallet card that is considered a legal document. If you get into an accident, the doctor will see you have a POA and contact the person you have listed. According to the Royal LePage House Price Survey1, the aggregate price of a home in Canada has continued to post steady year-over-year gains during the third quarter of 2019 as the real estate market sustained its recovery from the significant downturn of 2018 and early 2019, following the introduction of the federal mortgage stress test. The Royal LePage National House Price Composite, compiled from proprietary property data in 63 of the nation's largest real estate markets, showed that the median price of a home in Canada increased 1.4 per cent year-over-year to $630,335 in the third quarter of 2019. When broken out by housing type, the median price of a two-storey home rose 1.3 per cent year-over-year to $738,346, while the median price of a bungalow remained flat at $521,250. Nationally, condominiums remained the fastest appreciating housing type, with the median price rising 3.4 per cent year-over-year to $457,911. Data analyzed contains both resale and new build transactions, provided by Royal LePage's sister company, RPS Real Property Solutions. "Low interest rates and an outstanding employment picture continue to buoy consumer confidence and support our recovering real estate market," said Phil Soper, president and CEO, Royal LePage. "The collateral damage from the trade war between the U.S. and China has been manageable to date. Barring a full-blown American recession, our outlook for Canada's housing sector is for continued market expansion." Looking to the fourth quarter of 2019, Royal LePage forecasts that the aggregate price of a home in Canada will rise 1.5 per cent year-over-year to $632,226, which is a 0.3 per cent increase compared to the third quarter of 2019. The 2019 fourth quarter forecast is dependent on consistent economic conditions and no new housing policy changes. To view the chart with aggregated regions and markets visit rlp.ca/houseprices. For more regional analysis, visit Royal LePage's media room at rlp.ca/mediaroom. 1 Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions. ck here to edit.According to the Royal LePage House Price Survey1, the aggregate price of a home in Canada has continued to post steady year-over-year gains during the third quarter of 2019 as the real estate market sustained its recovery from the significant downturn of 2018 and early 2019, following the introduction of the federal mortgage stress test. The Royal LePage National House Price Composite, compiled from proprietary property data in 63 of the nation's largest real estate markets, showed that the median price of a home in Canada increased 1.4 per cent year-over-year to $630,335 in the third quarter of 2019. When broken out by housing type, the median price of a two-storey home rose 1.3 per cent year-over-year to $738,346, while the median price of a bungalow remained flat at $521,250. Nationally, condominiums remained the fastest appreciating housing type, with the median price rising 3.4 per cent year-over-year to $457,911. Data analyzed contains both resale and new build transactions, provided by Royal LePage's sister company, RPS Real Property Solutions. "Low interest rates and an outstanding employment picture continue to buoy consumer confidence and support our recovering real estate market," said Phil Soper, president and CEO, Royal LePage. "The collateral damage from the trade war between the U.S. and China has been manageable to date. Barring a full-blown American recession, our outlook for Canada's housing sector is for continued market expansion." Looking to the fourth quarter of 2019, Royal LePage forecasts that the aggregate price of a home in Canada will rise 1.5 per cent year-over-year to $632,226, which is a 0.3 per cent increase compared to the third quarter of 2019. The 2019 fourth quarter forecast is dependent on consistent economic conditions and no new housing policy changes. To view the chart with aggregated regions and markets visit rlp.ca/houseprices. For more regional analysis, visit Royal LePage's media room at rlp.ca/mediaroom. 1 Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions. Kritchanut via Getty Images The cost of rental housing jumped by the most in 30 years in January, according to Statistics Canada data. If you've been paying the bills in your household, you've probably noticed that some things have fallen in price (gas), and some things have been largely stable (shoes and clothing, for instance). But if you've been shopping around for an apartment to rent, you've probably experienced sticker shock. The cost of renting an apartment in Canada shot up 0.9 per cent in a single month in January, according to Statistics Canada, the fastest one-month leap since August, 1989. And even though the hike took place in the first month that StatCan is using a new method to estimate rental costs, the agency insists it's not a statistical distortion. "This one-month movement reflects price change and not a change in methodology. However, given the new methodology, the variation we see now will be different than what we've seen in the past under the previous methodology," the agency said in a statement emailed to HuffPost Canada. Benjamin Reitzes, a senior economist at Bank of Montreal, says StatCan's measure of rental rates has been "subdued for decades" and probably missed the spike in rental rates that has been taking place in recent years. "The new way they measure it is actually capturing what's going on," he said. And what's going on is rental rate increases that are quite widespread, spreading well beyond the priciest markets. The latest data on asking rates for apartments from rental site Padmapper shows double-digit increases in 12 of the 24 cities covered. Asking rates for one-bedroom apartments in Toronto jumped 10.2 per cent over the past year, to an average of $2,270, while in Vancouver rates rose 4.5 per cent, to $2,080, and Montreal rents jumped 11.1 per cent, to $1,500. Many experts say the jump in rents over the past two years has to do with the slowdown in the owner-occupied housing market. Many would-be homebuyers have been priced out of the housing market due to the new mortgage stress test or rising interest rates, forcing people to stay in rental housing longer.

At the same time, Canada's population growth has accelerated over the past few years, leading to the fastest population growth in several decades. A Bank of Montreal report from last year suggested the experts may be underestimating how much new housing Canada needs. Some policy analysts say a lack of purpose-built rental housing and government-subsidized housing is contributing to the problem. Most governments in Canada long ago stopped adding to their stock of affordable housing, and are now struggling to maintain their existing housing stock. Rental apartment construction has been slow for decades, even as condo construction has exploded. By Daniel Tencer It takes less time to sell a house in quiet Maritime markets than it does in bustling Montreal.

We've been hearing from our readers lately that real estate news focuses too much on Toronto and Vancouver and not enough on the rest of the country. This is a legitimate point. Both within the industry and among the public, there's been a fascination with these two markets. And there's some reason for that. As recently as 2015, the Toronto and Vancouver metro areas accounted for 29 per cent of all home sales in Canada. But with the recent slowdown in those cities, they're becoming less important to the overall market, accounting for only 22 per cent of sales in 2018. So it's time to take a look at what's going on in all those other markets that aren't Toronto or Vancouver. In the coming weeks, we'll be featuring stories on conditions in Canada's smaller and medium-sized markets — or at least as much data as we can find, because there are often gaps in those smaller communities. This week we are drilling down through Canadian Real Estate Association statistics to see just how long it takes to sell a house in the many varied markets across the country. Despite a sharp slowdown in home sales across southern Ontario in recent months, these cities are still the places where houses "fly off the shelves," as it were, at breakneck speed. The shortest time period in the country is in Windsor (yes, population-of-200,000 Windsor), where it typically takes 12 days to sell a house. Compare that to 134 days in Saguenay, Que., the longest period reported by any real estate board in Canada. In fact, the bottom of the list is dominated by municipalities in Quebec. Even Montreal, which had the strongest housing market among major cities in 2018, has a 74-day average selling time, compared to 23 days in Toronto and 56 in Greater Vancouver, which had far weaker housing markets in the past year. It takes less time to sell a house in most Maritime cities than it does in a bustling Montreal. Go figure.By Daniel Tencer Photo: James Bomblaes

2018 began with a steep nationwide drop in housing activity. Stricter mortgage qualification rules pushed buyers to the sidelines, as year-over-year double-digit sales decreases became the norm. Of course, some markets had a rougher year than others. Toronto, with its strong early-2017 performance, had a particularly cool start to the year, as did Hamilton. In the west, the Calgary market is continues to deal with the effects of low oil prices which sunk the housing market in 2015, while Vancouver is still adjusting to a stricter foreign buyers tax that was increased in February. What does 2019 have in store for these troubled markets? Livabl has combed through the latest forecasts from industry experts, to give you an idea of what to expect. Toronto should remain stable With its record performance in 2017, the Toronto housing market became the epitome of the old adage “the bigger they are, the harder they fall” in 2018. While activity took its steepest dive in the spring of 2017, with the introduction of the Ontario government’s Fair Housing Plan, sales dropped dramatically in January, as the market struggled to adjust to the new mortgage stress test. Over the summer months, the city began to see a slow month-over-month rise in sales and prices. That’s led several experts — including Phil Soper, president and CEO of Royal LePage — to predict a relatively cool, but stable, 2019. Sales were up 6 percent year-over-year in October, while listings fell a slight 2.7 percent. “The numbers [you saw] in the GTA [in October] are the direct result of strong demand amid relatively limited supply,” Soper tells Livabl. It’s a sentiment echoed by TD economist Rishi Sondhi, who wrote in his latest forecast that the Toronto housing market would remain balanced in the new year, as strong demand pushed up against deteriorating housing affordability. “Toronto’s market has been balanced for over a year now, manifesting in slower price appreciation,” he writes. “Strained affordability conditions, exacerbated by rising borrowing costs, will continue to restrain demand.” Hamilton will cool slightly The Hamilton market, which has long been a refuge for those priced-out of Toronto, largely mimicked the larger city’s sales trajectory in 2018. Home sales are predicted to fall 15.9 percent year-over-year by the end of 2018, according to the latest data from Central 1 Credit Union. Many industry experts are predicting that the cooler period will last well into 2019, while noting that the city’s strong fundamentals will keep things from changing too drastically. “What you have in Hamilton is a relatively affordable market, that allows those who cannot afford to live in Toronto a chance to own a home, while still commuting to work,” Hamilton-based realtor Mike Heddle tells Livabl. “That’s a trend that’s not going to change any time soon.” Earlier this year, BMO economist Robert Kavcic named Hamilton one of Canada’s most attractive labour markets, arguing that the city’s strong job market will likely draw prospective homeowners in the new year. “Given that Toronto has been held back by significant pressure on housing affordability, cities like Hamilton…within commuting distance of Toronto jobs, have served as a release valve,” he wrote. Calgary oversupply issue to persist At first glance, there’s something that appears to bode well for Calgary’s ownership housing market: the rental market is tightening. Normally, this has a knock-on effect for home sales. As a vacancy rate trends lower, rents get more expensive due to competition for apartments, and some decide it’s worth it to purchase a home. This time is different, suggests one expert. Lower oil prices have persistently taken a toll on home sales and prices in Calgary, and even though the rental market looks to be picking up, Keith Reading, director of research for Morguard, recently said it would be 18 months before demand is sufficient to drive rents up. From there, it would still be a number of years before any meaningful improvements are seen on the resale and new-home markets. While the Calgary Real Estate Board has yet to publish its final lookahead at 2019, its chief economist Ann-Marie Lurie recently gave Livabl an idea of what to expect. “The current situation that we’re in is we have an oversupplied market, prices have been trending down, and we just haven’t seen the pickup in the economy — at least in Calgary — as what was expected, so that’s really what we’re seeing leading into next year,” Lurie said in an interview earlier this month. Vancouver will continue to correct When it comes to Vancouver’s housing market, the peaks and troughs of various forecasts from analysts vary as wildly as the mountainous landscape surrounding the city. For instance, credit union Central 1 predicts the median price of a Metro Vancouver home will drop by about 3 percent next year before remaining flat in 2020. “A modest housing price correction is underway in the region triggered by rising interest rates and federal mortgage criteria which is intensified by provincial policy measures,” writes Bryan Yu, Central 1’s Deputy Chief Economist, noting a recent hike to the regional foreign-homebuyer tax and proposed speculation taxes. Compare that to Capital Economics’ latest analysis: based on rising levels of inventory, activity drying up, and tougher federal mortgage rules introduced back in January, home resale prices could fall 5 percent next year, in the research firm’s estimation. Perhaps the most dramatic prediction comes by way of Eitel Insights, which used stock market-style analysis to forecast the future of detached home prices in Vancouver. While the benchmark price of a detached home was $1,524,000 last month, Eitel Insights anticipates that number will fall to $1.4 million between next year and 2021 at the latest. Like Capital Economics and Central 1, Dane Eitel, the owner of Eitel Insights, bases his bearish take on the impact of the federal government’s move at the beginning of the year to extend stress testing to uninsured mortgages. Previously, a borrower could put down 20 percent for a loan from a big Canadian bank and sidestep the test. While the relative affordability of multi-family dwellings in Vancouver has provided somewhat of a buffer for the pre-construction condo market despite new mortgage qualifying regulations, rising supply levels are expected to put downward pressure on prices in this segment, too. Already, new-home prices are down between 5 and 15 percent, depending on location and housing type, according to Urban Analytics. Sarah Niedoba and Josh Sherman Dec 4, 2018 Everything you need to know about legalized pot and what’s to come in OntarioIt's legalization day for recreational use of cannabis. If you are 19 years of age or older, you can now buy, consume and grow recreational marijuana in Ontario. You can also share up to 30 grams of pot among adults over 19. While buying edibles remains illegal for another year, you can make marijuana food and drinks at home. But you are only limited to carrying up to 30 grams of dried cannabis in public. Residents are also limited to growing a maximum of four plants per household at any given time. Smoking pot now permitted in public places Late Wednesday afternoon, Ontario passed its cannabis legislation, firmly establishing the right to smoke marijuana in public in the province. The bill was put to a final vote hours after recreational use of the drug became legal across Canada. The legislation loosens regulations established by the previous Liberal government, allowing Ontario residents to smoke recreational cannabis wherever tobacco smoking is permitted. Lt.-Gov. Elizabeth Dowdeswell will be asked to proclaim it into law immediately, officials said. Under the new law, you can smoke and vape cannabis at the following places:

In August, the provincial government announced it would scrap brick and mortar OCS locations and move toward a private retail system. The system, which the government describes as "tightly controlled" would be governed by the Alcohol and Gaming Commission Ontario, and OCS will be the only wholesaler to these stores. The provincial government is giving municipalities until Jan. 22, 2019 to opt out of allowing private retailers within their boundaries. Driving high will result in fines, zero tolerance for those under 21 The province has implemented zero tolerance for those under 21 caught driving under the influence of weed, regardless of licence status, and those with learners' permits (G1, G2, M1 or M2) Legalization of recreational marijuana is expected to impact many aspects of life. Policies are either already re-written or are in the process of re-written. With files from the Canadian Press CBC's Journalistic Standards and Practices|About CBC News Sarah Niedoba Oct 1, 2018

It’s long been an accepted fact that self-employed Canadians have difficulty qualifying for mortgages. But that could be able to change, now that new lending rules are in place. Starting today, new guidelines from Canada Mortgage and Housing Corp. (CMHC) will make it easier for anyone who has been self-employed for less than two years to qualify for a mortgage. The new rules will ask lenders to consider additional factors in their decision-making process, such as predictable earnings, cash reserves and education. Housing Market News AlertsSign up now for news alerts on the Canadian housing market “Self-employed Canadians represent a significant part of the Canadian workforce,” writes CMHC chief commercial officer Romy Bowers, in a statement. “These policy changes respond to that reality by making it easier for self-employed borrowers to obtain CMHC mortgage loan insurance and benefit from competitive interest rates.” Roughly 15 per cent of Canadians identify as self-employed, according to CMHC data, and the agency predicts that the number will increase as the “gig economy” continues to grow. Approved lenders, including the country’s big banks, are under no strict obligation to observe the new guidelines, though it is likely that each will take their own approach to the new rules, according to CMHC spokesperson Audrey-Anne Coulombe. “Implementation of CMHC guidelines may vary among lenders,” she tells Livabl. “These new guidelines are meant to be principle based and not to be too prescriptive to provide maximum flexibility for lenders.” SEE ALSO: A jump in sales marks the start of the GTA fall housing market, according to expertsShe adds that the overall objective of the rules was to provide additional guidance to self-employed Canadians looking to qualify for a mortgage. “These policy changes will make it easier for self-employed borrowers to obtain CMHC mortgage loan insurance and benefit from competitive interest rates,” she shares. |

Archives

August 2020

Categories |

RSS Feed

RSS Feed